The old way of sending money to someone. Before the Core Banking system was not implemented in banks, there were a number of means we used to transact money. We have seen postal money order too. We go to the post office and deposit certain amount. At the receiving end postman delivers the money in a few days.

Postal money order might take a few days to settle the funds. Just like the postal money order, a demand draft is also a means for sending funds from a person to another.

Here what happen is that, when you want to send funds to someone, you go to the bank and purchase a demand draft.

It requires physical transfer of the instrument (demand draft) to the person you are sending funds.

So, you transfer this draft to that person and he encash it by presenting to his bank.

This

fund transfer with demand draft can be done within different banks.

Though fund settlement is time consuming but it was a safer means of

transaction.

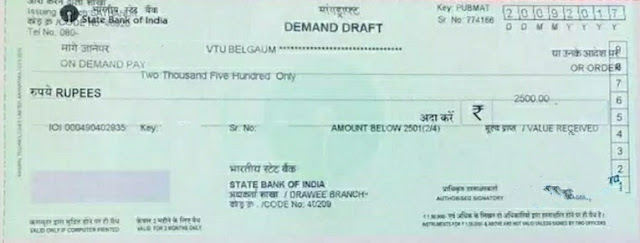

Let's see a few more details about a demand draft.

What is a demand draft?

As per NI Act 1881, a demand draft is a negotiable instrument that the bank issue to the buyer directing the other bank branch to pay a specific person or party on-demand or on presentation.

In layman's words, a person purchases the DD instrument with a specific amount of funds to get it transferred to other parties.

Demand draft is as good as real money that is why bank do not issue bearer demand draft. It should be always order demand draft.

Means on presentation to your bank only you get the funds.

So, in the demand draft, there are certain things which are worth knowing.

Some useful stuff

Once the demand draft is delivered to other parties for payment, it cannot be cancelled by the purchaser.

The demand draft is valid for 3 months.

Demand draft cannot be revalidated once it is expired or stale. It has to cancell and purchase as a fresh demand draft.

A duplicate demand draft can be obtained on the production of a letter of indemnity.

The

original demand draft will not be paid if a duplicate demand draft is

presented earlier and paid. It will be returned unpaid stating that the

duplicate demand draft is paid.

No demand

draft can be issued in cash if the amount is more than ₹ 20000. It can

be purchased only through account payee and a PAN number is mandatory to

purchase it.

Reserve Bank has made a PAN number mandatory to curve money laundering under Anti Money Laundering Act.

Recently RBI announces that it has been made mandatory to put the purchaser's name on the demand draft.

Uses of demand draft

Once demand draft was a very popular mode of payment since it was much safer to carry demand draft rather than carrying a whole lot of money.

But

as every good stuff comes along with its drawbacks. Money launderer

took the advantage and used it as a tool to defraud and laundered

money.

Moreover, during manual time it was very easy to forge at one point in time.

At

present, it's far safer than those old manual demand drafts. Thanks to

the new generation technology that led to the end of misuse of demand

draft.

As the new version of this instrument is almost impossible to duplicate or forge.

There

is no way it could hack and launder money, as Reserve Bank has

streamlined its issuance policy by the bank and put serious SOPs on it.

Some of the uses demand drafts are as follows

- Payment of School and Colleges fees.

- Payment of utility bills.

- Payment of any third party.

But

the onset of the technology-driven mode of payment makes it worthless,

as people nowadays prefer the instant payment model rather than the old

school time-consuming money transfer.

The growing trend of preferring online payment rather than purchasing demand draft

The trend of using demand drafts for financial transactions is getting obsolete. Nowadays its uses are minimal.

All those payments used to do by these instruments are almost replaced by online payment gateways including internet banking, card payment and other third-party applications such as Paytm, Google Pay, and Paypal just to name a few.

Certain

institutes and governmental transactions are still relying on it. The

rest are almost shifted to instant payment type in CBS.

How it differs from a banker's cheque

The banker's cheque and demand draft are just the same. Both of them are paper-based instruments governed under NI Act and both are negotiable instruments.

The only difference is banker's cheque is for local payment.

It

means this instrument is issued only for local payment where demand

draft is issued for a specific amount ordered to pay to a specific

person on presentation at anywhere, even you can purchase foreign

currency demand draft.

That means you can purchase a demand draft ordering your banker to pay your friend who is staying in Delhi.

But

here you need to transfer ownership of the demand draft to your friend

and on presentation of this demand draft by your friend to his banker,

he would be able to withdraw the money, either by presenting it to the

drawee bank or by collecting it through his banker for clearing.

Some terminology related to demand draft

- Drawer bank branch: Bank branch where demand draft is issued.

- Drawee bank branch: Bank branch where demand draft is drawn to.

- Favour of: Where/Whom you intend to send the money.

- Demand draft purchaser or drawer: Person who purchase the demand draft.

.png)

0 Comments